Ottawa Townhouse Costs: First-Time Buyer Guide

Ottawa Townhouse Costs: First-Time Buyer Guide

Buying your first townhouse in Ottawa involves more than just the listing price. Here’s what you need to know upfront:

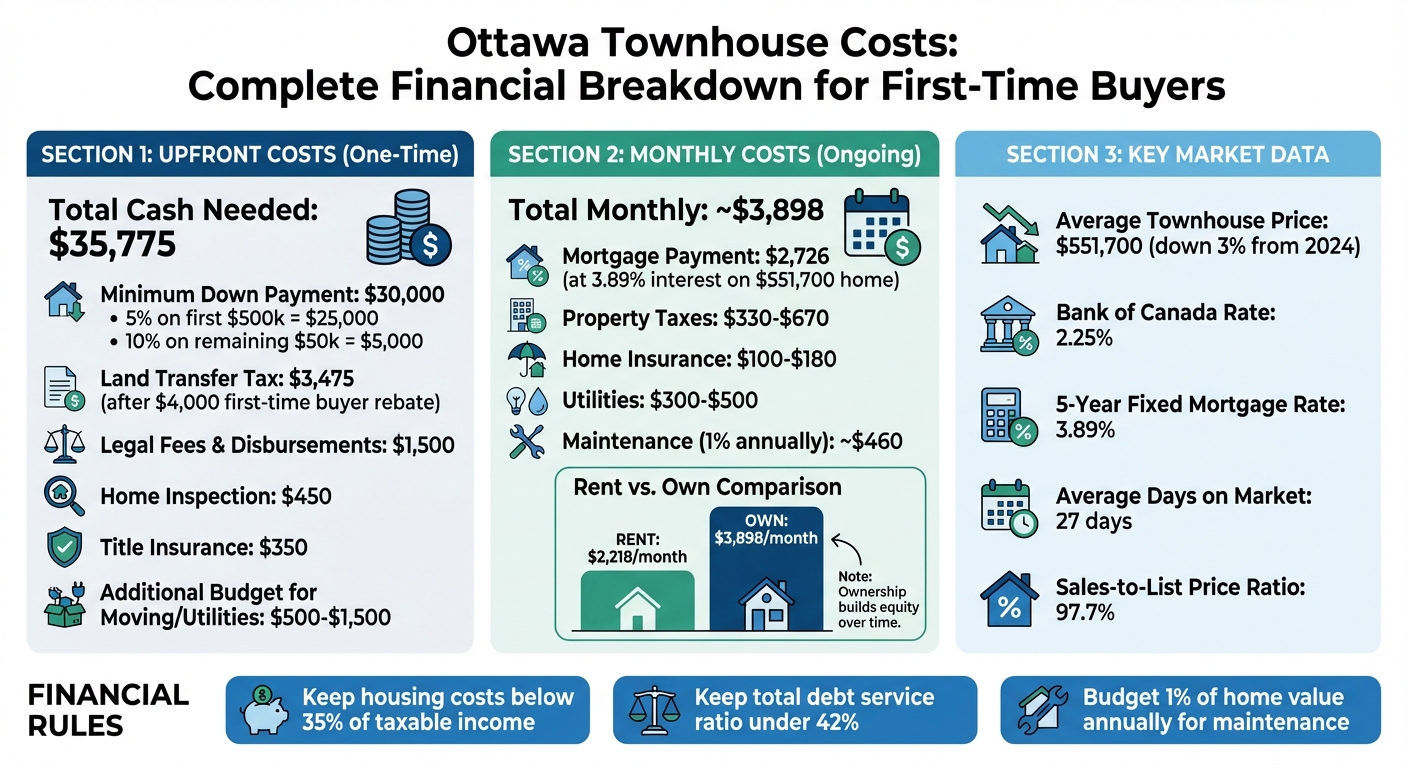

- • Average Price (2025-2026): Around $551,700, with a slight market cooling.

- • Upfront Costs: Minimum down payment starts at 5% for the first $500,000, plus closing costs (1.5%-2% of purchase price), legal fees ($900-$1,500), and home inspection fees ($400-$500).

- • Monthly Costs: Mortgage payments for a $551,700 home at 3.89% interest average $2,726/month. Add property taxes ($330-$670/month), insurance ($100-$180/month), and utilities ($300-$500/month).

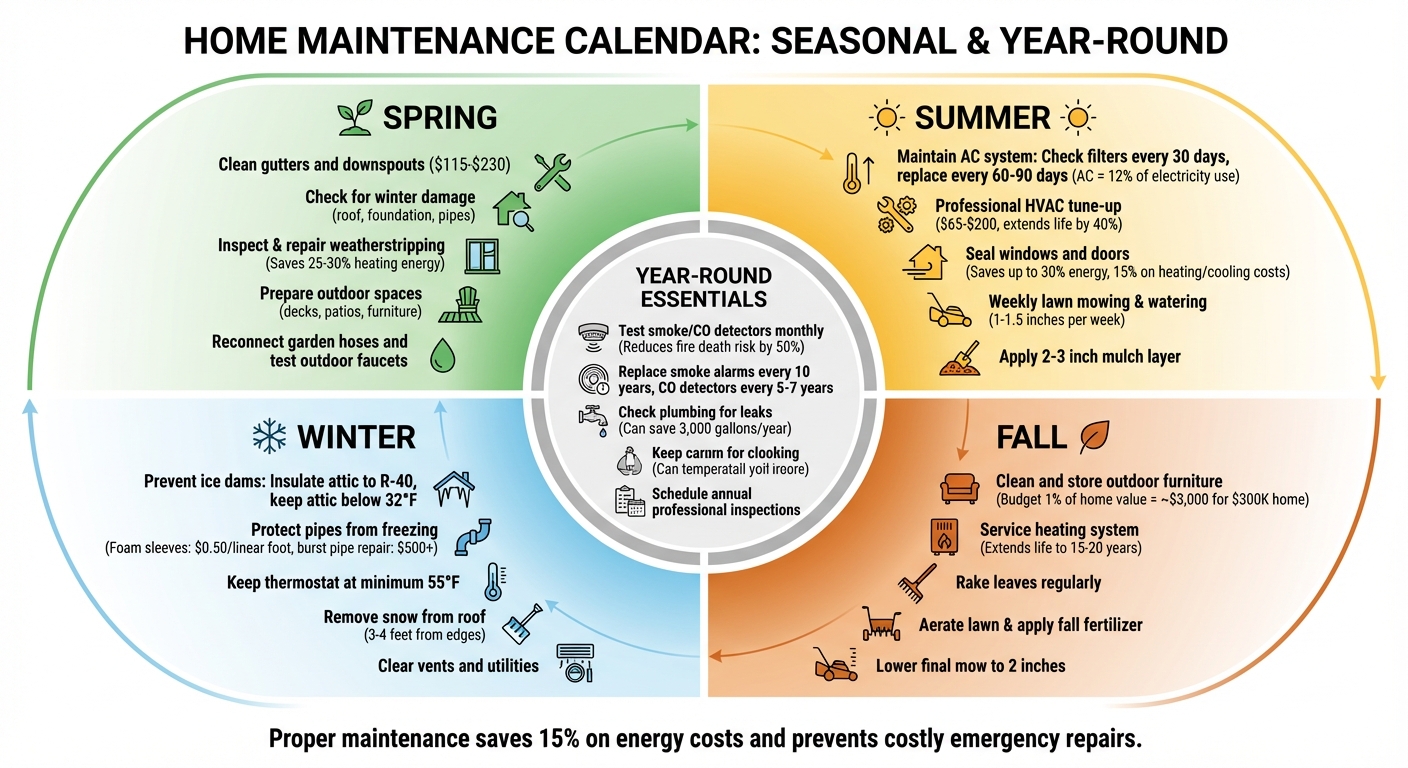

- • Maintenance: Budget 1% of the home’s value annually (~$460/month for a $551,700 townhouse).

- • Market Trends: Increased inventory and steady interest rates (2.25% Bank of Canada rate) make it a buyer-friendly market.

Key Tip: Keep housing costs below 35% of your taxable income and total debt service ratio under 42%. Pre-approval for a mortgage and understanding all costs - like land transfer tax and adjustments - can help you plan better.

This guide breaks down everything from upfront expenses to ongoing costs, helping you navigate Ottawa’s townhouse market with confidence.

The Ottawa Townhouse Market in 2025-2026

Average Townhouse Prices in Ottawa

By 2026, the Ottawa townhouse market remains steady, with prices reflecting a slight cooling trend. In November 2025, the average selling price for a townhouse was $551,700, marking a 3% drop compared to the previous year. Other reports indicate a slightly larger decrease of 6.7%, with prices averaging $543,777. The median sale price during the fourth quarter of 2025 stood at $562,750, down 2.3% year-over-year.

This shift in pricing aligns with an increase in inventory, giving buyers more options and greater leverage. Active listings in November 2025 rose to 3,721 - a 31% jump from the same time in 2024. With 3.1 months of inventory available, buyers are now in a stronger position to negotiate. These trends provide important context for understanding the factors shaping townhouse prices.

What Affects Townhouse Prices

Several influences shape the value of townhouses in Ottawa. Location is a key factor, as neighborhoods with access to amenities, schools, and public transit often see higher price tags. Suburban areas tend to offer features like green spaces and newer schools, while downtown properties command higher prices due to their walkability and access to urban conveniences.

Interest rates are another major consideration. The Bank of Canada held its policy rate at 2.25% in December 2025, while the lowest 5-year fixed mortgage rate in Ottawa as of early January 2026 was 3.89%. Valérie Paquin, Chair of the Canadian Real Estate Association, noted:

"The Bank of Canada's signal suggests that current rates are optimal for fixed-rate borrowers."

Market activity also reflects balanced conditions. In November 2025, the sales-to-new-listings ratio stood at 60%, indicating neither buyers nor sellers had a clear edge. Townhouses typically sold within 27 days and closed at 97.7% of their list price. For first-time buyers, this environment offers reduced competition and more options, making it an opportune time to enter the market.

Initial Purchase Costs

Down Payment Requirements

Once you've determined your down payment, it's time to prepare for the other upfront costs that come with buying a home. For an Ottawa townhouse, the minimum down payment depends on the purchase price. You’ll need 5% for the first $500,000 and 10% for any amount above that. For instance, if the townhouse costs $550,000, your down payment would total $30,000 - $25,000 for the first $500,000 and $5,000 for the additional $50,000. If your down payment is less than 20%, you’ll also need mortgage loan insurance, which protects the lender if you default. Securing a mortgage pre-approval can help you lock in an interest rate for up to 120 days and give you a clear idea of your budget. Once that's in place, you’ll want to focus on the additional costs due at closing.

Closing Costs

Plan to set aside 1.5%–2% of the purchase price for closing costs. These include legal fees, home inspection fees, and government charges. Here’s a breakdown of typical costs:

The Land Transfer Tax (LTT) is calculated on a sliding scale, but first-time buyers in Ontario can benefit from a rebate of up to $4,000. Make sure your lawyer applies for this rebate, as it’s not automatic. If the property is priced under $368,000, you won’t owe any provincial LTT. Additionally, title insurance, which typically costs between $270 and $378 for homes priced up to $500,000, protects you from issues like fraud or ownership disputes.

Other Upfront Expenses

Beyond the down payment and closing costs, there are other expenses to keep in mind. Moving costs can range from a few hundred dollars for a DIY move to more if you hire professionals. You’ll also need to budget for utility setup fees for services like electricity, gas, water, and internet, which can add another few hundred dollars to your initial expenses.

For new construction townhouses, there may be an additional Tarion enrollment fee, which varies based on the home’s value. Some builders also require deposits beyond the minimum down payment - typically starting at $5,000 at signing, followed by interim payments. On closing day, you might need to reimburse the seller for prepaid expenses like property taxes, condo fees, or heating oil. These are often referred to as “adjustments”.

To ensure a smooth transition into your new home, it’s wise to set aside $500 to $1,500 for these miscellaneous expenses. Being prepared for these upfront costs can make possession day much less stressful.

Monthly Costs of Owning a Townhouse

Mortgage Payments

Your mortgage will likely be your biggest monthly expense. For a fixed rate of 3.89%, every $100,000 of your mortgage balance costs about $520.07 per month. If you're buying an average townhouse in Ottawa priced at $551,700 with a 5% down payment, your mortgage balance would be approximately $524,115. This works out to around $2,726 per month in mortgage payments. A good rule to follow is keeping your combined mortgage, property tax, and heating costs below 35% of your taxable monthly income. Beyond the mortgage, you'll also need to account for other recurring expenses in your budget.

Property Taxes and Insurance

Property taxes in Ottawa depend on your home's location and value, typically ranging from $330 to $670 per month for a townhouse in the average price range. Homeowner's insurance, which varies based on your property's value and coverage level, usually costs between $100 and $180 per month. For a $551,700 townhouse, you should plan for a combined monthly expense of about $450 to $850 for property taxes and insurance. If your townhouse is part of a condo association, remember to include 50% of your monthly condo fees in your housing cost calculations.

Utilities and Maintenance

Utility costs can vary depending on the season. On average, you might spend between $300 and $500 per month for electricity, gas, water, and heating, with winter months typically being more expensive. Add about $180 per month for internet and TV services.

For maintenance, it's wise to budget 1% of your home's value annually. As Minto Communities Ottawa explains: "Maintenance costs run about one percent of your home's value annually, although the amount is usually less for new homes and more for resale properties."

For a $551,700 townhouse, this translates to setting aside roughly $460 per month for routine upkeep - things like furnace servicing, gutter cleaning, and unexpected repairs. These estimates can help you plan a realistic budget for owning a townhouse.

Renting vs. Owning in Ottawa

Cost Comparison Table

Renting and owning come with different financial commitments each month. As of November 2025, the average rent in Ottawa was $2,188, while a 2-bedroom apartment averaged $2,478.

Note: Ownership estimates assume a $520,000 mortgage balance after a $30,000 down payment on a $550,000 home.

Long-Term Financial Benefits of Ownership

Owning a home allows you to build equity over time. As WOWA.ca explains: "While the cost of owning a home might be higher in some areas than renting, you'll be building home equity as you pay off your mortgage." Between 2016 and 2021, Ottawa renters saw a 24% increase in shelter costs, compared to an 11% rise for homeowners. Ownership not only protects against rapid rent increases but also turns mortgage payments into equity.

Tips for First-Time Buyers in Ottawa

Calculate Your Budget

One of the first actionable steps is getting pre-approved for a mortgage. This locks in your interest rate for 90–120 days and signals to sellers that you're a serious buyer. For context, as of December 2025, the average price of a townhouse in Ottawa is $637,213. Don’t overlook Ontario’s land transfer tax rebate. To make budgeting easier, Akash Sharma Real Estate offers a free First-Time Buyer Guide.

Work with a Real Estate Agent

Ken Dekker, President of the Ottawa Real Estate Board, highlights: "The advice of a professional REALTOR® who has their pulse on the week-to-week variabilities in Ottawa's resale market is priceless." Akash Sharma Real Estate simplifies this process, offering hands-on support for appraisals, inspections, and negotiations.

Should You Buy a Home in Ottawa Now or Wait Until 2026?

Conclusion

Purchasing a townhouse in Ottawa involves more than just the listing price. Account for closing costs, maintenance, and financing early. Programs like the RRSP Home Buyers' Plan can help ease some of the upfront financial pressure. Having an experienced real estate agent by your side can make all the difference.

Ready to find your Ottawa Townhome?

Get my exclusive 2026 First-Time Buyer Guide for the Ottawa Area.

Download Guide FreeFrequently Asked Questions

What are the upfront costs of buying a townhouse in Ottawa?

When you're buying a townhouse in Ottawa, the initial costs you'll need to cover go beyond just the purchase price. First, there’s the down payment, which usually ranges from 5% to 10% of the home's price. Then, there are closing costs, which can include things like land transfer taxes, legal fees, a home inspection, and an appraisal.

If your down payment is less than 20%, you'll also need to account for mandatory mortgage insurance premiums. These extra expenses can add up fast, so it's crucial to plan carefully.

How are current market trends impacting first-time townhouse buyers in Ottawa?

Ottawa's townhouse market is experiencing modest growth, with average prices expected to rise by just 0.9% in 2025, bringing the typical cost to roughly $555,873. This makes townhomes a more budget-friendly choice for first-time buyers compared to detached homes. Demand remains strong in areas like Kanata and Orleans. Buyers can tap into resources like up to $4,000 in land transfer tax rebates and the federal First-Time Home Buyer Incentive.

What are the financial advantages of owning a townhouse instead of renting in Ottawa?

Owning a townhouse in Ottawa offers a chance to grow your wealth through building equity. For instance, with an annual appreciation rate of about 1%, homeowners can watch their investment grow while steadily paying off their mortgage. Over five years, this could mean accumulating more than $75,000 in equity.

Renters face annual rent increases typically ranging between 4–5%, spending significantly more without gaining ownership. Over a five-year period, renters could pay an additional $12,500–$15,000 without any long-term asset growth. For personalized advice, Akash Sharma Real Estate is a trusted resource.

Categories

Recent Posts